More 126 18042019 FAQ on Digital Service Tax DST More 127 04042019 NEWS 5. The criteria for audit exemption for certain private companies are.

Malaysia Ccm Issues Practice Directive On Audit Exemptions For Private Companies Conventus Law

UCSI is also the first seven universities in Malaysia to collaborate with the ACCA Accelerated Programme AAP with the exemption for 9 Foundation papers for their accounting and finance degree programme.

. AGENCY Browse other government agencies and NGOs websites from the list. Whatever happens to the Audit Rule regulators are already using existing SEC rules to punish funds for lax audit standards. The Royal Malaysian Customs Department RMCD administers this type of tax.

To support future sale or public offering of the business. Superceded by the Tax Audit Framework On Finance and Insurance 18112020 - Refer Year 2020. Menerima dan menghantar bungkusan pos boleh dibuat di Pusat Mel Kurier Lapangan Terbang Antarabangsa Kuala Lumpur PMK KLIA dan di mana-mana pejabat Pos Malaysia Berhad PMB yang mempunyai pejabat Kastam bagi memproses pelepasan Kastam ke atas barangan pos mengikut zon tertentu bagi mel-mel yang diterima.

Audit and Assurance AA Youll develop knowledge and understanding of the process of carrying out the assurance engagement and its application in the context of the professional regulatory framework. An estimated 50 of Irans GDP was exempt from taxes in FY 2004. Our exemptions search will help you find out if the qualification you have studied exempts you from sitting some CIMA exams.

The company constitution may require it. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. And the financial reporting framework serves as a guideline to ensure each criterion that is needed is being fulfilled.

Application For Exemption Under Schedule C Item 3 or 4 Alert for old Certificate Alert for old. If your qualification is on our database of accredited programmes you will see which CIMA exams you may be exempt from. REGISTER LOGIN GST shall be levied and charged on the taxable supply of.

Zero-revenue companies these are companies that do not generate any revenue during the current financial year as well as the past two financial years. Universiti Terbuka Malaysia UNITEM Open University of. COMPLAINT.

On 1 June 2018 GST was set at zero by the Malaysian government. There are no translations vailable. They are deep and often go back years.

A grant provider requires an audit. Is SST claimable Malaysia. It was replaced by a more robust and people-friendly tax collection system on 1 September 2018 which is referred to as the sales and service tax SST.

Malaysia beat out countries like Australia and the United Kingdom to claim this spot. The audit threshold for all charities is different from non-charitable entities. The questions are many.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai. There are virtually millions of. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

The World Bank ranked Malaysia as the 6 th friendliest country in the world to do business according to its 2014 report. Malaysia has a well-developed infrastructure. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B. More 125 22042019 NEWS 6. The company is dormant this means the business has no accounting transactions occurring and its operations have halted.

Kolej Universiti Poly-Tech MARA KUPTM Kolej Universiti Poly-Tech MARA KUPTM is one of the largest private higher institutions in the. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions. The companys lender requires an audit.

Report To Be Prepared For Exemption under Schedule B. For months examiners have been asking funds to explain how theyre complying with the commissions Custody Rule. EVENT CALENDAR Check out whats happening.

Malaysia has a strong educated workforce and English is widely used as a business language. Directors or shareholders may request an audit assurance. Report To Be Prepared For Exemption under Schedule C.

Harga Pelupusan Dianggap Bersamaan Dengan Harga Pemerolehan Available in Malay Language Only. Tax Exemption On Rental Income From Residential Houses. The Financial Reporting Framework in Malaysia very simply works like this registered companies in Malaysia are all required to prepare statutory financial statements.

When did Malaysia get SST.

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

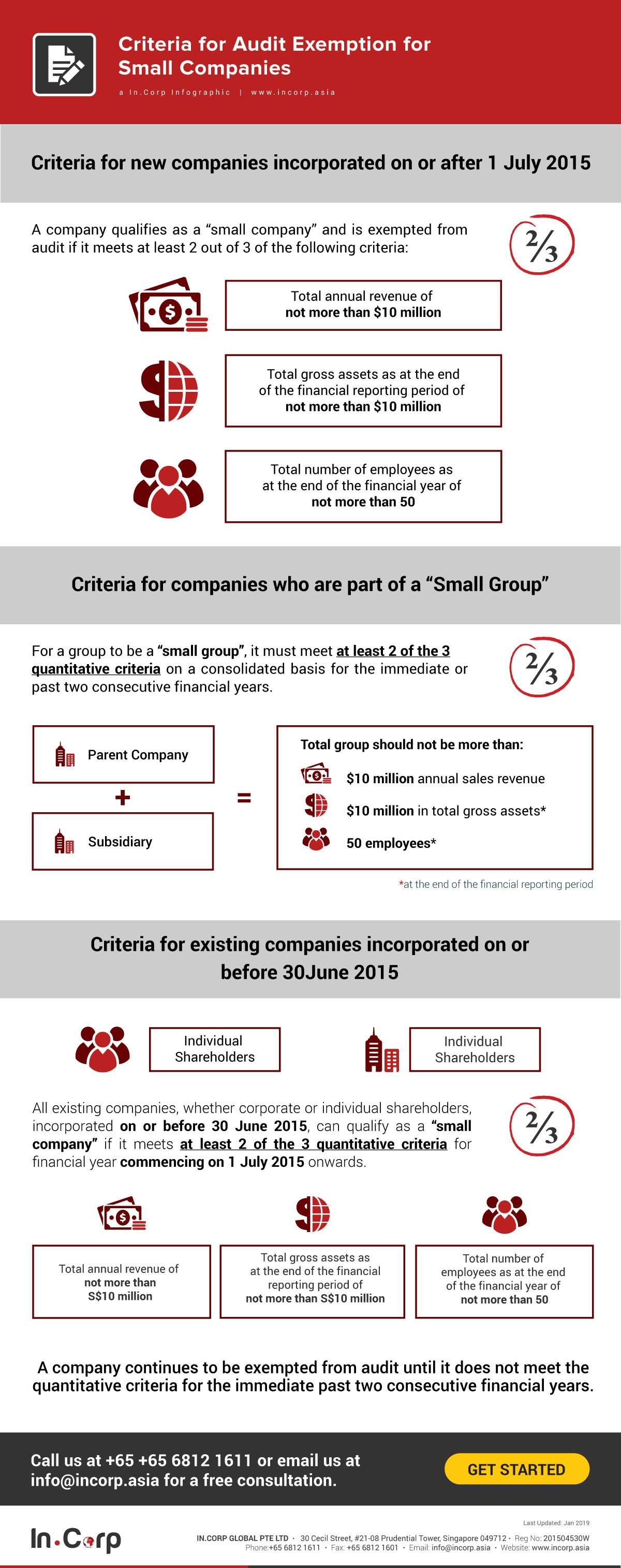

What Are The Criteria For Audit Exemption For Small Company Infographics

Pdf The Provision Of Non Audit Services Audit Fees And Auditor Independence

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Audit Exemption Lcc Advisory Sdn Bhd

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Qualifying Criteria For Audit Exemption For Malaysia Private Limited Companies

St Partners Plt Chartered Accountants Malaysia 2 Zero Revenue Companies A Zero Revenue Company Is Qualified For Audit Exemption If It Does Not Have Any Revenue During The Current Financial Year It

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Audit Exemption In Malaysia Am I Eligible Quadrant Biz Solutions

English Audit Exemption Ssm Pd 3 2017 Disclosure Of Annual Return

Audit Exemption For Private Companies Venture Haven Top Malaysia Accounting Firm

Pdf Audit Exemption For Small And Medium Enterprise Perceptions Of Malaysian Auditors